KBS Real Estate

Investment Trust III, Inc.

Proxy Vote

KBS Real Estate

Investment Trust III, Inc.

Proxy Vote

Message from the CEO

The Purpose

Why is this Happening

We will hold our annual meeting of stockholders at the offices of KBS, 800 Newport Center Drive, First Floor, Suite 140 Conference Center, Newport Beach, California 92660 on May 7, 2020 at 8:00 a.m. Pacific.

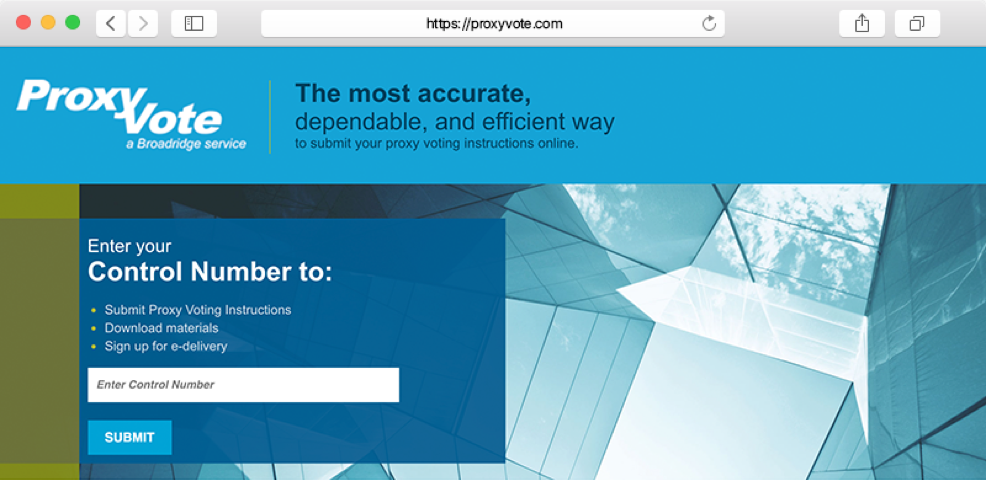

The meeting will be held on Thursday, May 7, 2020 at 8:00 a.m. Pacific. To participate in the virtual annual meeting, you will need the 16-digit control number included on your proxy card or your voting instruction form. For more information CLICK HERE.

The objectives of the annual meeting of stockholders are as follows:

01

Elect Directors

To elect four directors to hold office for one-year terms.

02

Ratify Appointment of Ernst & Young LLP

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019.

03

Remove Section 5.11 from Charter

To remove Section 5.11 from our charter, which requires that we seek stockholder approval of our liquidation if our shares of common stock are not listed on a national securities exchange by September 30, 2020, unless a majority of our independent directors determines that liquidation is not then in the best interest of our stockholders. This proposal will not take effect unless Proposal 4 below is also approved.

04

Approve Acceleration of Incentive Compensation

To approve the acceleration of the payment of incentive compensation to KBS Capital Advisors LLC, our external advisor, in the form of restricted shares of our common stock. This proposal will not take effect unless Proposal 3 above is also approved.

05

Adjournment Proposal

To permit us to proceed with voting on and approval of only the proposals that have received sufficient votes to be approved at the annual meeting, and then subsequently, to adjourn the annual meeting to solicit additional proxies to vote in favor of any proposal that has not received sufficient votes to be approved at the annual meeting.

06

Other Business

To attend to such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

Your Vote Matters

- Your approval of two proposals is sought related to our conversion to an “NAV REIT”

If our stockholders vote against either Proposal 3 or Proposal 4, our board of directors will meet to determine whether to continue with a perpetual-life NAV REIT strategy or what other reasonably available alternatives to pursue in the best interest of the company and our stockholders, including, without limitation, continuing to operate under the current business plan.

-

Your vote makes

a difference

You are entitled to one vote for each share of common stock you held as of the record date.

Stockholders are encouraged to vote as early as possible to help avoid delays and additional expenses associated with soliciting stockholder votes.

-

Board

recommendation

The KBS Real Estate Investment Trust III, Inc. board of directors recommends that stockholders vote FOR all proposals described in the voter proxy card.

Next Steps

What do I need to do?

Online

OR

Phone

Complete, sign, date and return the proxy card in the pre-paid envelope provided.

If you misplaced or have trouble locating your control number, please call our Proxy Help Line toll free at 1 (855) 643-7458.

Explanation of Key Proxy Proposals

There are two proposals related to our pursuit of conversion to a non-listed perpetual-life “NAV REIT.”

At the annual meeting, we will seek your approval of, among other proposals, two proposals related to our pursuit of conversion to a non-listed perpetual-life “NAV REIT.”

We currently believe the best opportunity for us to achieve our objectives to provide attractive and stable cash distributions to our stockholders and provide additional liquidity for our stockholders is to pursue a strategy as a non-listed, perpetual-life “NAV REIT” that calculates the net asset value or “NAV” per share on a regular basis that is more frequent than annually (i.e. daily, monthly or quarterly), and seeks to provide increased liquidity to current and future stockholders through an expansion of our current share redemption program and/or periodic self-tender offers.

A revised advisory fee structure will be implemented.

As more thoroughly described in the proxy statement, if we pursue conversion to an NAV REIT, we would implement a revised advisory fee structure, including a revised management fee and incentive fee structure that put a greater emphasis on our performance. We believe these changes would help further align the interests of our advisor (and its affiliates) and our stockholders in growing our company and performing well. In addition to the revised management fee and incentive fee structure, the new fee structure would eliminate the current transaction-based fees (i.e., the acquisition fee and disposition fee) payable to our advisor.

Proposal 3: Amending the Company’s Charter to remove Section 5.11

We believe we are more likely to succeed with a perpetual-life NAV REIT strategy if we revise our charter to remove Section 5.11, which requires that we seek stockholder approval of our liquidation if our shares of common stock are not listed on a national securities exchange by September 30, 2020, unless a majority of our independent directors determines that liquidation is not then in the best interest of our stockholders.

We believe that the continued inclusion of Section 5.11 in our charter may create confusion if we are pursuing a perpetual-life NAV REIT strategy and we are proposing that stockholders approve this amendment to our charter.

Proposal 4: Acceleration of Incentive Compensation

With respect to the incentive fee structure currently in effect with our advisor, the triggering events for payment of the incentive fee are generally expected to occur, if ever, upon a listing of our shares of stock on a national securities exchange or a significant distribution of cash in connection with a sale of all or a substantial amount of our assets.

These triggering events are inconsistent with a perpetual-life NAV REIT.

With respect to our historical performance period from inception through our conversion to a perpetual-life NAV REIT, we believe it is appropriate to accelerate the payment of the historical incentive fee in the form of restricted shares of our common stock so that it does not depend on the currently-existing triggering events.

The acceleration of the payment of the historical incentive compensation to our advisor will not affect the net asset value of our shares of common stock because our net asset value calculation has always included the potential liability related to the incentive fee.

Because the acceleration of this fee is not something we intended to do when we launched our initial public offering, we believe it is appropriate to ask the stockholders for their approval of this acceleration.

The historical incentive fee would be paid in restricted shares of our common stock and would be subject to certain restrictions as described further in the proxy statement.

The board of directors recommends a vote FOR the proposals presented on your proxy card.

Questions & Answers

Questions about Annual Meeting and Voting

Questions about Plan of Liquidation Proposal

You owned shares of record of our common stock at the close of business on January 8, 2020, the record date for the annual meeting and, therefore, are entitled to vote at the annual meeting of stockholders. The board of directors is soliciting your proxy to vote your shares at the annual meeting. Our proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and is designed to assist you in voting. You do not need to attend the annual meeting in person in order to vote.

A proxy is a person who votes the shares of stock of another person who could not attend a meeting. The term “proxy” also refers to the proxy card or other method of appointing a proxy. When you submit your proxy, you are appointing Charles J. Schreiber, Jr., Jeffrey K. Waldvogel and Stacie K. Yamane, each of whom is one of our executive officers, as your proxies, and you are giving them permission to vote your shares of common stock at the annual meeting. The appointed proxies will vote your shares of common stock as you instruct, unless you submit your proxy without instructions. If you submit your proxy without instructions, they will vote:

- FOR all of the director nominees,

- FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019,

- FOR the proposal to amend our charter,

- FOR the proposal to approve the acceleration of the payment of incentive compensation to KBS Capital Advisors LLC, our external advisor (“KBS Capital Advisors”), in the form of restricted shares of our common stock, and

- FOR the proposal that would permit us to proceed with voting on and approval of only the proposals that have received sufficient votes to be approved at the annual meeting, and then subsequently, to adjourn the annual meeting to solicit additional proxies to vote in favor of any proposal that has not received sufficient votes to be approved at the annual meeting.

With respect to any other proposals to be voted upon, the appointed proxies will vote in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion. It is important for you to submit your proxy via the Internet or by telephone or return your proxy card to us as soon as possible, whether or not you plan on attending the annual meeting.

The annual meeting will be held on Friday, May 7, 2020, at 8:00 a.m. Pacific time at the offices of KBS, 800 Newport Center Drive, First Floor, Suite 140 Conference Center, Newport Beach, California 92660.

Anyone who is a stockholder of record at the close of business on January 8, 2020, the record date, or holds a valid proxy for the annual meeting, is entitled to vote at the annual meeting. In order to be admitted to the annual meeting, you must present proof of ownership of our stock on the record date. Such proof can consist of: a brokerage statement or letter from a broker indicating ownership on January 8, 2020; a proxy card; a voting instruction form; or a legal proxy provided by your broker or nominee. Any holder of a proxy from a stockholder must present the proxy card, properly executed, and a copy of the proof of ownership.

Note that our advisor, KBS Capital Advisors, which owned 20,857 shares of our common stock as of the record date, has agreed to abstain from voting any shares it owns in any vote regarding: (i) the removal of our advisor, a director or any of their affiliates or (ii) any transaction between us and our advisor, a director or any of their affiliates. As such, KBS Capital Advisors will not vote on Proposals 3 or 4 due to the interests of KBS Capital Advisors and its principals in the Proposed Net Asset Value REIT Conversion, as defined and described in “Proposed NAV REIT Conversion” in the proxy statement.

Yes. Your vote could affect the proposals described in the proxy statement. Moreover, your vote is needed to ensure that the proposals described in the proxy statement can be acted upon. Because we are a widely held company, YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

As of January 8, 2020, there were 181,338,858 shares of our common stock outstanding and entitled to be cast at the annual meeting. See also, “Who is entitled to vote at the annual meeting?” above.

A quorum consists of the presence in person or by proxy of stockholders entitled to cast 50% of all the votes entitled to be cast at the annual meeting on any matter. There must be a quorum present in order for the annual meeting to be a duly held meeting at which business can be conducted. No business may be conducted at the annual meeting if a quorum is not present. If you submit your proxy, even if you abstain from voting, then you will still be considered part of the quorum.

If a quorum is not present at the annual meeting, the chairman of the meeting may adjourn the annual meeting to another date, time or place, not later than 120 days after the original record date of January 8, 2020. Notice need not be given of the new date, time or place if announced at the annual meeting before an adjournment is taken.

You are entitled to one vote for each share of common stock you held as of the record date.

Our board of directors and management team regularly monitor the real estate and equity markets in order to find the best opportunities possible to continue to provide attractive and stable cash distributions to our stockholders and provide additional liquidity for our stockholders. We currently believe the best opportunity for us to achieve these objectives is to pursue a strategy as a non-listed, perpetual-life company that calculates the net asset value or “NAV” per share on a regular basis that is more frequent that annually (i.e., daily, monthly or quarterly) and seeks to provide increased liquidity to current and future stockholders through an expansion of our current share redemption program and/or periodic self-tender offers. We have seen significant appreciation in the portfolio to date and we believe there are still many opportunities in the marketplace to achieve strong stockholder returns through a combination of providing strong cash distributions and timing asset sales to maximize value. Furthermore, we believe a number of our existing investments are still in the process of maturing and therefore may not yet have reached their maximum value. With respect to liquidity, we believe that a number of sources of capital can be used to offer additional liquidity to stockholders that desire it through an expanded share redemption program and/or periodic tender offers. See “Proposed NAV REIT Conversion” in the proxy statement for more information.

As an NAV REIT, we believe we can (a) offer an expanded share redemption program, (b) have additional capital to fund redemptions, and (c) provide more frequent net asset value or “NAV” per share calculations, which will provide stockholders with more information when making liquidity decisions and also allow more frequent and representative pricing under our share redemption program. As an NAV REIT, we intend to revise our share redemption program to allow us to make monthly redemptions with an aggregate value of up to 5% of our NAV per calendar quarter. This would be a significant increase in maximum capacity compared to our current share redemption program, which limits redemptions of shares during any calendar year to no more than 5% of the weighted average number of shares outstanding during the prior calendar year. Our current share redemption program is also limited by funding restrictions that prevent us from redeeming the maximum number of shares permitted under the program, unless increased by our board of directors. While we are soliciting stockholders with respect to Proposals 3 and 4, the board of directors has determined to suspend ordinary redemptions under our share redemption program. Ordinary redemptions are all redemptions that do not qualify for the special provisions for redemptions sought in connection with a stockholder’s death, “Qualifying Disability” or “Determination of Incompetence” (each as defined in the share redemption program).Because the actual level of redemptions under our share redemption program as an NAV REIT would also depend on our ability to fund redemptions and our other capital needs, we may not be able to make redemptions up to the maximum capacity permitted by the program. However, our intention is to increase our stockholders’ access to liquidity through an expansion of our current share redemption program and/or through self-tender offers. See “Proposed NAV REIT Conversion” in the proxy statement for more information.

As we have previously disclosed, on July 18, 2019, we sold 11 of our properties (the “Singapore Portfolio”) to various subsidiaries of Prime US REIT (the “SREIT”), a newly formed Singapore real estate investment trust that listed on the Singapore Stock Exchange on July 19, 2019 (the “Singapore Transaction”). The sale price of the Singapore Portfolio was $1.2 billion, before third-party closing costs and excluding disposition fees payable to our external advisor. In connection with the Singapore Transaction, we repaid $613.1 million of outstanding debt secured by the properties in the Singapore Portfolio. Pursuant to a set-off agreement, as amended, $271.0 million of the consideration payable by the SREIT under the purchase agreement for the Singapore Portfolio was set-off against our indirect wholly owned subsidiary’s (“REIT Properties III”) payment obligations for its two subscriptions for units in the SREIT. As such, on July 19, 2019, REIT Properties III acquired 307,953,999 units in the SREIT at an aggregate price of $271 million representing a 33.3% ownership interest in the SREIT. On August 21, 2019, REIT Properties III sold 18,392,100 of its units in the SREIT for $16.2 million pursuant to an over-allotment option granted by REIT Properties III to the underwriters of the SREIT’s offering, reducing REIT Properties III’s ownership in the SREIT to 31.3% of the outstanding units of the SREIT. As of September 30, 2019, the SREIT does not own any properties other than the Singapore Portfolio. For more information, please see “Certain Information About Management—The Conflicts Committee—Certain Transactions with Related Persons—Singapore Transaction” in the proxy statement.

The Singapore Transaction has made additional capital available to us that we have and intend to continue to use to offer additional liquidity to our stockholders through our share redemption program and/or tender offers or through special distributions to stockholders after our stockholders have had an opportunity to vote on Proposals 3 and 4 at the annual meeting or any adjournment or postponement thereof. We believe we will have greater success as an NAV REIT if we are able to eliminate any pent-up demand for redemptions prior to the conversion.

You may vote on:

- the election of the nominees to serve on the board of directors;

- the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019;

- the removal of Section 5.11 from our charter (this proposal will not take effect unless Proposal 4 below is also approved);

- the approval of the acceleration of the payment of incentive compensation to our advisor, in the form of restricted shares of our common stock (this proposal will not take effect unless Proposal 3 above is also approved);

- the proposal that would permit us to proceed with voting on and approval of only the proposals that have received sufficient votes to be approved at the annual meeting, and then subsequently, to adjourn the annual meeting to solicit additional proxies to vote in favor of any proposal that has not received sufficient votes to be approved at the annual meeting; and

- such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

The board of directors recommends that you vote:

- FOR each of the nominees for election as director who is named in the proxy statement;

- FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019;

- FOR the removal of Section 5.11 from our charter;

- FOR the proposal to approve the acceleration of the payment of incentive compensation to our advisor, in the form of restricted shares of our common stock; and

- FOR the proposal that would permit us to proceed with voting on and approval of only the proposals that have received sufficient votes to be approved at the annual meeting, and then subsequently, to adjourn the annual meeting to solicit additional proxies to vote in favor of any proposal that has not received sufficient votes to be approved at the annual meeting.

Section 5.11 of our charter requires that, if we do not list our shares of common stock on a national securities exchange by September 30, 2020, we either:

- seek stockholder approval of the liquidation of the company; or

- if a majority of the conflicts committee determines that liquidation is not then in the best interests of our stockholders, postpone the decision of whether to liquidate the company.

This section further states that if a majority of the conflicts committee does determine that liquidation is not then in the best interests of our stockholders, the conflicts committee must revisit the issue of liquidation at least annually. The conflicts committee is a committee of our board of directors consisting solely of all of our independent directors, that is, all of our directors who are not affiliated with KBS Capital Advisors, our external advisor.

As described further in the proxy statement, we believe that the continued inclusion of Section 5.11 in our charter may create confusion for existing and new investors if we are pursuing a perpetual-life company strategy. We believe that its continued inclusion may create doubts as to our long-term commitment to the perpetual-life strategy. In addition, complying with Section 5.11 is likely to create an annual burden on the time and focus of our board of directors and conflicts committee and may create significant additional expenses, in particular if the board of directors or conflicts committee solicits input from advisors regarding the charter determination required by Section 5.11. For these reasons, our board of directors believes we are more likely to succeed with a perpetual-life strategy if we remove Section 5.11 from the charter and has proposed its removal. In order to remove Section 5.11 from the charter, we need the approval of our stockholders. This proposal will not take effect unless the proposal to approve the acceleration of the payment of incentive compensation to our advisor is also approved.

The triggering events for the incentive fee structure currently in effect with our advisor are generally expected to occur, if ever, upon a listing of our shares of stock on a national securities exchange or a significant distribution of cash in connection with a sale of all or a substantial amount of our assets. These triggering events are inconsistent with a perpetual-life NAV REIT that intends to provide liquidity to its stockholders through a share redemption program and/or periodic self-tender offers. Therefore, in order to properly align our advisor’s and its affiliates’ incentive fee compensation structure with our proposed perpetual-life strategy, we intend to revise the incentive fee structure. Commencing with our conversion to a perpetual-life NAV REIT, we intend to implement an annual incentive fee formula that would require us to pay our advisor (or its affiliate) an incentive fee for any given year if certain performance thresholds were met for that year. We expect that this incentive may be payable in cash or units of KBS Limited Partnership III (the “Operating Partnership”), which our advisor or its affiliate could request to be repurchased at a later date. With respect to our historical performance period from inception through our conversion to a perpetual-life NAV REIT, we believe it is appropriate to accelerate the payment of the historical incentive fee so that it does not depend on the currently-existing triggering events. See “Proposed NAV REIT Conversion” in the proxy statement for more information. Because the acceleration of this fee is not something we intended to do when we launched our initial public offering, we believe it is appropriate to ask the stockholders for their approval of this acceleration. Therefore, we are asking our stockholders to approve the acceleration of the payment of incentive compensation to our advisor. This proposal will not take effect unless the proposal to amend our charter is also approved.

We expect this acceleration payment would be made in the form of restricted shares of our common stock (“Restricted Shares”) with terms that are still under consideration, but are currently expected to be structured as follows:

- Each Restricted Share would be one share of our common stock.

- The Restricted Shares would be awarded in connection with our conversion to an NAV REIT.

- The number of Restricted Shares awarded would equal the number of our shares of common stock, valued at the then-current NAV per share at the time of the award (i.e., the NAV per share at the time of our conversion to an NAV REIT), with a value equal to the estimated value of the Subordinated Participation in Net Cash Flows based on a hypothetical liquidation of our assets and liabilities at their then-current estimated values used in the NAV calculation at the time of conversion to an NAV REIT, after considering the impact of any potential closing costs and fees related to the disposition of real estate properties. The foregoing would be calculated by our advisor (or its affiliate) in its good faith and approved by the conflicts committee, which is composed of all our independent directors.

- The Restricted Shares awarded would vest after two years, provided the advisor or its affiliate is not terminated for “cause” during that time (where “cause” means fraud, criminal conduct if the advisor or its affiliate would have reasonable cause to believe that the conduct was unlawful, willful misconduct, or an uncured material breach of the advisory agreement). Both we and the advisor would have certain rights to accelerate vesting in certain situations, such as a change of control of our company.

- We would agree with the advisor prior to the award of the Restricted Shares to repurchase 50% of the Restricted Shares upon vesting, with the repurchase price determined based on the then-current value of our shares. The main reason we would agree to repurchase 50% of the Restricted Shares upon vesting is to allow the advisor to have cash to pay its taxes.

- The Restricted Shares would be entitled to dividends and have the same voting rights as all other shares of common stock.

- After vesting and excluding the initial repurchase of 50% of the Restricted Shares upon vesting, the shares the advisor receives pursuant to this agreement would not be eligible for redemption under our share redemption program unless the company has satisfied all redemption requests from other stockholders received at that time; this restriction may be lifted in certain situations, such as upon a change of control of our company.

Under our charter, we are required to limit our total operating expenses to the greater of 2% of our average invested assets or 25% of our net income for the four most recently completed fiscal quarters, as these terms are defined in our charter, unless the conflicts committee has determined that such excess expenses were justified based on unusual and non-recurring factors. Because the award of Restricted Shares would be deemed an operating expense under our charter, such award may cause us to exceed the charter limitation on total operating expenses. We expect that any agreement to award Restricted Shares to our advisor would provide that (i) the conflicts committee has determined that the expense to us as a result of such award is justified based on unusual and non-recurring factors and (ii) the advisor will not be required to reimburse us any expenses under this charter provision to the extent that we exceed the limit on total operating expenses as a result of the expense incurred in connection with the award of Restricted Shares. Though the award of Restricted Shares is an expense under our charter and generally accepted accounting principles, the award would not reduce our cash flow from operations.

No. The acceleration of the payment of incentive compensation to our advisor will not affect the net asset value of our shares of common stock because our net asset value calculation has always included the potential liability related to the incentive fee. Therefore, the acceleration of the incentive compensation to our advisor will not impact the net asset value per share compared to what the value would be if this payment was not accelerated.

The new fee structure puts a greater emphasis on our performance and, accordingly, could result in greater compensation to our advisor and its affiliates as a percentage of our NAV if we perform sufficiently well. Furthermore if we succeed in growing our company, we would expect the fees paid to our advisor and its affiliates to increase because of our larger size. We believe these changes help further align the interests of our advisor (and its affiliates) and our stockholders in growing our company and performing well. The actual future impact to our stockholders of the proposed compensation changes is difficult to predict because it is subject to a number of factors, such as the size or value of the portfolio and our performance. In addition to the revised management fee and incentive fee structure, the new fee structure would eliminate the current transaction-based fees (i.e., the acquisition fee and disposition fee) payable to our advisor. See “Proposed NAV REIT Conversion—Terms of Proposed NAV REIT Conversion—Revised Advisory Fee Structure” in the proxy statement for more information.

No. With or without Section 5.11 of the charter, our board of directors regularly considers our various strategic alternatives and accordingly would expect to consider changing strategies if it concludes that it is in the best interests of our stockholders to do so. These strategic alternatives can consist of any number of options including a public listing of our shares on a national stock exchange, selling assets individually, and /or selling the entire portfolio in a single transaction.

Removal of Section 5.11 from the charter is not required in order for the company to pursue a perpetual-life NAV REIT strategy. However, we believe we are more likely to succeed with the strategy if we remove Section 5.11 of the charter. Similarly, stockholder approval of acceleration of the payment of incentive compensation to our advisor is not required in order for the company to pursue a perpetual-life NAV REIT strategy. However, we believe the change is appropriate in connection with the pursuit of a perpetual-life NAV REIT strategy. For this reason, neither Proposal 3 nor Proposal 4 will take effect unless both are approved by our stockholders. If our stockholders vote against either Proposal 3 or Proposal 4, our board of directors will meet to determine whether to continue with a perpetual-life NAV REIT strategy or what other reasonably available alternatives to pursue in the best interest of the company and our stockholders, including, without limitation, continuing to operate under the current business plan. As previously discussed, the Singapore Transaction has made additional capital available to us that we have and intend to continue to use to offer additional liquidity to our stockholders through our share redemption program and/or tender offers or through special distributions to stockholders after our stockholders have had an opportunity to vote on Proposals 3 and 4 at the annual meeting or any adjournment or postponement thereof.

The conflicts committee of our board of directors, which is composed of all our independent directors, has approved the pursuit of a perpetual-life NAV REIT, which includes submitting to stockholders for their approval the proposal to remove Section 5.11 of the charter and the proposal to accelerate the payment of incentive compensation to the advisor. However, implementation of the proposed charter amendment and the proposed acceleration of the payment of incentive compensation to the advisor remain subject to further approval of the conflicts committee, after the proposed amount of the accelerated payment of the incentive fee has been determined.

Stockholders can vote in person at the annual meeting, as described above under “Who is entitled to vote at the annual meeting?”, or by proxy. Stockholders have the following three options for submitting their votes by proxy:

- via the Internet, by accessing the website and following the instructions indicated on the proxy card;

- by telephone, by calling the telephone number and following the instructions indicated on the proxy card; or

- by mail, by completing, signing, dating and returning the proxy card.

For those stockholders with Internet access, we encourage you to vote by proxy via the Internet, since it is quick, convenient and provides a cost savings to us. When you vote by proxy via the Internet or by telephone prior to the annual meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted. For further instructions on voting, see the proxy card.

If you elect to attend the annual meeting, you can submit your vote in person as described above under “Who is entitled to vote at the annual meeting?”, and any previous votes that you submitted, whether by Internet, telephone or mail, will be superseded.

You have the right to revoke your proxy at any time before the annual meeting by:

- notifying Mr. Waldvogel, our Secretary;

- attending the annual meeting and voting in person as described above under “Who is entitled to vote at the annual meeting?”;

- returning another proxy card dated after your first proxy vote, if we receive it before the annual meeting date; or

- recasting your proxy vote via the Internet or by telephone.

Only the most recent proxy vote will be counted and all others will be discarded regardless of the method of voting. If a broker or other nominee holds your stock on your behalf, you must contact your broker, bank or other nominee to change your vote.

With regard to the election of directors, you may vote “FOR” a nominee or you may withhold your vote for a nominee by voting “WITHHOLD.” Under our charter, a majority of the shares present in person or by proxy at an annual meeting at which a quorum is present is required for the election of the directors. This means that, of the shares present in person or by proxy at an annual meeting, a director nominee needs to receive affirmative votes from a majority of such shares in order to be elected to the board of directors. Because of this majority vote requirement, “withhold” votes and broker non-votes (discussed below) will have the effect of a vote against each nominee for director. If an incumbent director nominee fails to receive the required number of votes for reelection, then under Maryland law, he or she will continue to serve as a “holdover” director until his or her successor is duly elected and qualified. If you submit a proxy card with no further instructions, your shares will be voted FOR each of the nominees.

With regard to the proposal relating to the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019, you may vote “FOR” or “AGAINST” the proposal, or you may “ABSTAIN” from voting on the proposal. Under our bylaws, a majority of the votes cast at an annual meeting at which a quorum is present is required for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019. Abstentions will not count as votes actually cast with respect to determining if a majority vote is obtained under our bylaws and will have no effect on the determination of this proposal. Your shares may be voted for this proposal if they are held in the name of a brokerage firm even if you do not provide the brokerage firm with voting instructions. If you submit a proxy card with no further instructions, your shares will be voted FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019.

With regard to the proposals to amend our charter and to approve the acceleration of the payment of incentive compensation to our advisor, you may vote “FOR” or “AGAINST” the proposals, or you may “ABSTAIN” from voting on the proposals. Approval of the proposals to amend our charter and to approve the acceleration of the payment of incentive compensation to our advisor requires the affirmative vote of the holders of at least a majority of our outstanding shares of common stock entitled to vote thereon. Abstentions and broker non-votes will have the same effect as votes against the proposals to amend our charter and to approve the acceleration of the payment of incentive compensation to our advisor. If you submit a proxy card with no further instructions, your shares will be voted FOR the proposals to amend our charter and to approve the acceleration of the payment of incentive compensation to our advisor.

With regard to the adjournment proposal (which would permit us to proceed with voting on and approval of only the proposals that have received sufficient votes to be approved at the annual meeting, and then subsequently, to adjourn the annual meeting to solicit additional proxies to vote in favor of any proposal that has not received sufficient votes to be approved at the annual meeting), you may vote “FOR” or “AGAINST” the proposal, or you may “ABSTAIN” from voting on the proposal. Approval of this proposal requires the affirmative vote of the holders of at least a majority of the votes cast thereon. Abstentions and broker non-votes will not have an effect on the outcome of this proposal. If you submit a proxy card with no further instructions, your shares will be voted FOR this proposal.

A “broker non-vote” occurs when a broker holding stock on behalf of a beneficial owner submits a proxy but does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that particular proposal and has not received instructions from the beneficial owner.

Brokers are precluded from exercising their voting discretion with respect to the approval of non-routine matters, such as the proposal to amend our charter and, as a result, absent specific instructions from the beneficial owner of such shares, brokers will not vote those shares. Broker non-votes will have the effect of a vote AGAINST the election of each nominee for director, AGAINST the proposal to amend our charter and AGAINST the proposal to accelerate the payment of incentive compensation to KBS Capital Advisors but will have no effect on the adjournment proposal. Because brokers have discretionary authority to vote for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, in the event they do not receive voting instructions from the beneficial owner of the shares, there will not be any broker non-votes with respect to that proposal.

Your broker will send you information to instruct it on how to vote on your behalf. If you do not receive a voting instruction card from your broker, please contact your broker promptly to obtain a voting instruction card. Your vote is important to the success of the proposals. We encourage all of our stockholders whose shares are held by a broker to provide their brokers with instructions on how to vote.

Although we do not know of any business to be considered at the annual meeting other than the proposals described in the proxy statement, if any other business is properly presented at the annual meeting, your submitted proxy gives authority to Messrs. Schreiber and Waldvogel and Ms. Yamane, and each of them, to vote on such matters in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion.

Any proposals by stockholders for inclusion in our proxy solicitation material for the next annual meeting of stockholders must be received by our Secretary, Mr. Waldvogel, at our executive offices no later than September 19, 2020. However, if we hold the next annual meeting before March 8, 2021 or after May 7, 2021, stockholders must submit proposals for inclusion in our proxy statement within a reasonable time before we begin to print our proxy materials. The mailing address of our executive offices is 800 Newport Center Drive, Suite 700, Newport Beach, California 92660. If a stockholder wishes to present a proposal at the next annual meeting, whether or not the proposal is intended to be included in our proxy materials, our bylaws require that the stockholder give advance written notice to our Secretary by October 19, 2020.

Due to widespread meeting cancelations relating to COVID-19, KBS has elected to postpone its April 7, 2020 annual meeting to May 7, 2020 at 8:00 a.m. Pacific time at the offices of KBS, 800 Newport Center Drive, First Floor, Suite 140 Conference Center,Newport Beach, California 92660.

In addition to mailing proxy solicitation materials, our directors and employees of our advisor or its affiliates may also solicit proxies in person, via the Internet, by telephone or by any other electronic means of communication we deem appropriate. Additionally, we have retained Broadridge Financial Solutions, Inc. (“Broadridge”), a proxy solicitation firm, to assist us in the proxy solicitation process.

Our directors and employees of our advisor or its affiliates will not be paid any additional compensation for soliciting proxies. We will pay all of the costs of soliciting these proxies, including the cost of Broadridge’s services. We anticipate that for Broadridge’s solicitation services we will pay approximately $73,500, plus reimbursement of Broadridge’s out-of-pocket expenses. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders.

You may receive more than one set of voting materials for the annual meeting, including multiple copies of the proxy statement and multiple proxy cards or voting instruction forms. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction form for each brokerage account in which you hold shares. If you are a holder of record and your shares are registered in more than one name, you will receive more than one proxy card and voting instruction form. For each and every proxy card and voting instruction form that you receive, please authorize a proxy as soon as possible using one of the following methods:

- via the Internet, by accessing the website and following the instructions indicated on the proxy card;

- by telephone, by calling the telephone number and following the instructions indicated on the proxy card; or

- by mail, by completing, signing, dating and returning the proxy card.

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the proxy statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of the proxy statement to you if you contact Broadridge at 855-643-7458.

We will file a Current Report on Form 8-K within four business days after the annual meeting to announce voting results. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

If you have any questions about the annual meeting, the proposals described herein and in the proxy statement, how to submit your proxy, or if you need additional copies of the proxy statement or the proxy card or voting instructions, you should contact Broadridge.

Broadridge Financial Solutions, Inc.

1-855-643-7458

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read any reports, statements or other information we file with the SEC on the website maintained by the SEC at http://www.sec.gov.

Our shares are illiquid and nearly all of our stockholders have held their stock for between nine and eleven years. As disclosed in the registration statement for our initial public offering, the charter required that we seek stockholder approval of our liquidation if our shares of common stock were not listed on a national securities exchange by March 2018, unless a majority of our conflicts committee determined that liquidation was not then in the best interest of our stockholders. The charter requires that the conflicts committee revisit the issue of liquidation at least annually. In March 2018 and in March 2019, the conflicts committee determined that liquidation was not then in the best interest of our stockholders.

On January 27, 2016, our board of directors formed a special committee (the “Special Committee”) composed of all of our independent directors to explore the availability of strategic alternatives involving us. As part of the process of exploring strategic alternatives, on February 23, 2016, the Special Committee engaged Evercore Group L.L.C. (“Evercore”) to act as our financial advisor and to assist us and the Special Committee with this process. Under the terms of the engagement, Evercore provided various financial advisory services, as requested by the Special Committee as customary for an engagement in connection with exploring strategic alternatives. Although the Special Committee engaged Evercore to assist us and the Special Committee with the exploration of strategic alternatives for us, we were not obligated to enter into any particular transaction or any transaction at all.

Following a review of the strategic alternatives presented by Evercore, in May 2016 we announced the determination of the Special Committee that it would be in our best interest and the best interest of our stockholders to market for sale the Company’s assets while it continued to explore strategic alternatives for us. Subsequent to that time, our Advisor recommended to the Special Committee and our board of directors that it would be in the best interest of our stockholders for the Company to market for sale and, if satisfactory prices were obtained, sell those of our properties that our Advisor believed were best positioned for sale in the near term, while continuing to operate the remainder of our portfolio with a view toward making the necessary enhancements to best position the remaining assets in our portfolio for sale. Those enhancements included addressing key lease expirations for certain of our remaining assets as well as executing on those capital projects recommended by our Advisor for our remaining assets.

As noted above, in each of March 2018 and 2019, our conflicts committee determined that liquidation was not then in the best interest of our stockholders. However, because of developments over the past six months with respect to the execution of several key leases and completion of capital projects that enhance property stability and better position our remaining assets for sale, on November 8, 2019, the Advisor discussed its detailed analysis of the state of and future outlook for the Company’s portfolio with the board of directors and the Special Committee, and our Advisor recommended to the board of directors and the Special Committee that it would be in our best interest and the best interest of our stockholders to engage in a planned liquidation pursuant to the Plan of Liquidation. The board of directors and the Special Committee carefully reviewed and considered the terms and conditions of the Plan of Liquidation and the transactions contemplated by that plan, as well as the other alternatives described in the proxy statement, and the Special Committee consulted with Evercore regarding Evercore’s view of the Company’s assets as well as its view of the Company’s other strategic alternatives, including a merger of the Company with another entity, a sale of the Company, a sale of the Company’s portfolio in a single transaction or a listing of the Company on a national securities exchange. See “What alternatives to the Plan of Liquidation have you considered?” below for a discussion of other alternatives considered.

On November 13, 2019, the board of directors and the Special Committee each concluded that a planned liquidation pursuant to the Plan of Liquidation was in the Company’s best interest and the best interest of our stockholders, and each unanimously determined that the terms of the Plan of Liquidation are fair to you, advisable and in your best interest. For a discussion of the reasons for the Plan of Liquidation, see “Proposal 1. The Plan of Liquidation Proposal – Reasons for the Plan of Liquidation Proposal; Recommendation of the Board of Directors and the Special Committee” in the proxy statement. The board of directors and the Special Committee then decided to seek your approval of the Plan of Liquidation. We currently estimate that if the Plan of Liquidation Proposal is approved by our stockholders and we are able to successfully implement the plan, our net proceeds from liquidation and, therefore, the amount of cash that you would receive for each share of our common stock that you then hold, could range between approximately $3.40 and $3.83 per share. We note that we previously paid (i) a special distribution in the amount of $4.50 per share to stockholders of record as of the close of business on September 15, 2014 and (ii) a special distribution of $0.45 per share to stockholders of record as of the close of business on June 17, 2019, all in connection with asset sales.

Our range of estimated net proceeds from liquidation is based upon market, economic, financial and other circumstances and conditions existing as of the date of the proxy statement, and any changes in such circumstances and conditions during the liquidation process could have a material effect on the ultimate amount of liquidating distributions received by stockholders.

We cannot complete the sale of all of our assets or our dissolution pursuant to the terms of the Plan of Liquidation unless our stockholders approve the Plan of Liquidation Proposal. If the Plan of Liquidation Proposal is not approved by our stockholders, the board of directors will meet to determine what other alternatives to pursue in the best interest of the Company and our stockholders, including, without limitation, continuing to operate under our current business plan. If the Plan of Liquidation is approved by our stockholders, we intend to pay the initial liquidating distribution within two months of stockholder approval, with such distribution to be funded with the proceeds from the sale of the Campus Drive Buildings. If the Plan of Liquidation Proposal is not approved, the board of directors will consider the best uses of the proceeds from such asset sale, which uses may include paying a special distribution to our stockholders, continuing to pay down debt, paying for capital expenditures related to certain of our real estate properties to reposition such properties or acquiring additional real estate assets.

The board of directors and the Special Committee also explored the options of:

- continuing under our current business plan; and

- seeking to dispose of our assets through a merger or a portfolio or whole-entity sale.

The board of directors and the Special Committee also considered a listing of our common stock on a national securities exchange. However, after consulting with Evercore and the Advisor, the board of directors and the Special Committee each concluded that because of the nature of the Company’s portfolio of properties, along with our externalized management structure, it would not be worthwhile to devote meaningful time or resources to evaluating a possible listing of our shares on a national securities exchange.

If we continue to operate under our current business plan, we may experience a decrease in cash flow due to the fixed costs associated with running a public REIT, asset sales and the costs of maintaining our properties. In this event, we may need to further revise our distribution policy.

After reviewing the other alternatives, and based on developments in the portfolio over the past six months with respect to key lease executions and the completion of certain capital projects that enhance property stability and better position our remaining assets for sale, the board of directors and the Special Committee concluded that a planned liquidation pursuant to the Plan of Liquidation was in the Company’s best interest and the best interest of our stockholders. For additional information on the board of directors’ and the Special Committee’s analysis of other strategic alternatives, see “Proposal 1. The Plan of Liquidation Proposal – Background of the Plan of Liquidation – Assessment of Strategic Alternatives” in the proxy statement.

Pursuant to Maryland law and the charter, you are not entitled to appraisal or dissenters rights (or rights of an objecting stockholder) in connection with the Plan of Liquidation.

The Plan of Liquidation authorizes us to undertake an orderly liquidation. In an orderly liquidation, we would sell all of our assets, pay all of our known liabilities, provide for the payment of our unknown or contingent liabilities, distribute our remaining cash to our stockholders, wind up our operations and dissolve.

In order to dissolve, we will file articles of dissolution (“Articles of Dissolution”) with the State Department of Assessments and Taxation of Maryland (the “SDAT”), our jurisdiction of incorporation, to dissolve the Company as a legal entity following the satisfaction of or provision for all our outstanding liabilities. The board of directors, in its sole discretion, will determine the timing for this filing. We expect to pay liquidating distributions to our stockholders during the liquidation process and to pay the final liquidating distribution after we sell all of our assets, pay or provide for all of our known liabilities and provide for unknown liabilities. We expect to complete these activities within 24 months after stockholder approval of the Plan of Liquidation. A final liquidating distribution to our stockholders may not be paid until all of our liabilities have been satisfied. Upon our liquidation and dissolution, the Company will cease to exist.

The Plan of Liquidation provides, in pertinent part, that, among other things:

- We will be authorized to sell all of our assets (including, if appropriate, through a whole-entity sale or sale of one or more of our subsidiaries or our direct or indirect ownership interests in these subsidiaries), liquidate and dissolve the Company, and distribute the net proceeds from liquidation in accordance with the provisions of the charter and applicable law. Although we currently anticipate that we will sell our assets for cash and our discussion in the proxy statement contemplates that we will receive cash for the sale of our assets, the Plan of Liquidation provides that our assets may be sold for cash, notes or such other assets as may be conveniently liquidated or distributed to our stockholders.

- We will be authorized to take all necessary or advisable actions to wind up our business, pay our debts, and distribute the remaining proceeds to our stockholders.

- We will be authorized to provide for the payment of any unascertained or contingent liabilities. We may do so by purchasing insurance, by establishing a reserve fund or in other ways.

- We expect to distribute all of the net proceeds from liquidation to you within 24 months after the date the Plan of Liquidation is approved by our stockholders. However, if we cannot sell our assets and pay our debts within 24 months, or if the board of directors and the Special Committee determine that it is otherwise advisable to do so, we may transfer and assign our remaining assets to a liquidating trust. Upon such transfer and assignment, our stockholders will receive beneficial interests in the liquidating trust. The liquidating trust will pay or provide for all of our liabilities and distribute any remaining net proceeds from liquidation to the holders of beneficial interests in the liquidating trust. The amounts that you would receive from the liquidating trust are included in our estimates described above of the total amount of cash that you will receive in the liquidation.

- Prior to the acceptance for record of the Articles of Dissolution by the SDAT, the board of directors may terminate the Plan of Liquidation for any reason, subject to and contingent upon the approval of such termination by our stockholders. Notwithstanding approval of the Plan of Liquidation by our stockholders, the board of directors or, if a liquidating trust is established, the trustees of the liquidating trust, may make certain modifications or amendments to the Plan of Liquidation without further action by or approval of our stockholders to the extent permitted under law.

- Upon our liquidation and dissolution, all of our outstanding shares of stock will be cancelled and the Company will cease to exist.

For more information, see “Proposal 1: The Plan of Liquidation Proposal” in the proxy statement.

As of the date of the proxy statement, we have entered into an agreement to sell the Campus Drive Buildings. For more information, see “Our Business and Assets” in the proxy statement. There can be no assurance that this disposition will close on the projected closing date or at all, or that the Campus Drive Buildings will sell for the projected sales price. In addition, this disposition is not contingent on stockholder approval of the Plan of Liquidation Proposal. The anticipated net proceeds from this sale are included in the range of estimated net proceeds from liquidation discussed in the proxy statement.

The amount of cash that may ultimately be received by our stockholders is not yet known. However, we currently estimate that if the Plan of Liquidation Proposal is approved by our stockholders and we are able to successfully implement the plan, our net proceeds from liquidation and, therefore, the amount of cash that you would receive for each share of our common stock that you then hold, could range between approximately $3.40 and $3.83 per share. We note that we previously paid (i) a special distribution in the amount of $4.50 per share to stockholders of record as of the close of business on September 15, 2014 and (ii) a special distribution of $0.45 per share to stockholders of record as of the close of business on June 17, 2019, all in connection with asset sales. There are many factors that may affect the amount of liquidating distributions available for distribution to our stockholders, including, among other factors: (i) the ultimate sale price of each asset, (ii) changes in market demand that affect the timing of the disposition of office properties during the liquidation process, (iii) the amount of taxes, transaction fees and expenses relating to the Plan of Liquidation, and (iv) amounts needed to pay or provide for our liabilities and expenses, including unanticipated or contingent liabilities that could arise. No assurance can be given as to the amount of liquidating distributions you will ultimately receive. If we have underestimated our existing obligations and liabilities or if unanticipated or contingent liabilities arise, the amount ultimately distributed to our stockholders could be less than that set forth above. In addition, these estimates are based upon market, economic, financial and other circumstances and conditions existing as of the date of the proxy statement, and any changes in such circumstances and conditions during the liquidation process could have a material effect on the ultimate amount of liquidating distributions received by our stockholders. See “Risk Factors” and “Proposal 1: The Plan of Liquidation Proposal – Background of the Plan of Liquidation” in the proxy statement.

If the Plan of Liquidation is approved by our stockholders, we intend to pay the initial liquidating distribution within two months of stockholder approval, with such distribution to be funded with the proceeds from the sale of the Campus Drive Buildings. We expect to pay multiple liquidating distribution payments to our stockholders during the liquidation process and to pay the final liquidating distribution after we sell all of our properties, pay all of our known liabilities and provide for unknown liabilities. We expect to complete these activities within 24 months after stockholder approval of the Plan of Liquidation. If we have not sold all of our properties and paid all of our liabilities within 24 months after stockholder approval of the Plan of Liquidation, or if the board of directors and the Special Committee otherwise determine that it is advantageous to do so, we may transfer our remaining assets and liabilities to a liquidating trust. We would then distribute beneficial interests in the liquidating trust to our stockholders. If we establish a reserve fund, we may pay a final distribution from any funds remaining in the reserve fund after we determine that all of our liabilities have been paid.

The actual amounts and timing of the liquidating distributions will be determined by the board of directors or, if a liquidating trust is formed, by the trustees of the liquidating trust, in their discretion. If you transfer your shares during the liquidation process, the right to receive liquidating distributions will transfer with those shares.

A liquidating trust is a trust organized for the primary purpose of liquidating and distributing the assets transferred to it. If we form a liquidating trust, we will transfer to our stockholders beneficial interests in the liquidating trust. This transfer of beneficial interests will constitute a taxable distribution to you in redemption of your ownership of our common stock. Beneficial interests in the liquidating trust will generally not be transferable by you.

In connection with the approval of the Plan of Liquidation by our board of directors, our board of directors determined to cease paying regular monthly distributions. Going forward we expect to satisfy the REIT distribution requirements through the payment of liquidating distributions. Every payment of distributions will be subject to the availability of cash and the discretion of the board of directors.

If our stockholders approve the Plan of Liquidation Proposal, after we have sold all of our assets, satisfied our liabilities, paid our final liquidating distribution to our stockholders and filed the Articles of Dissolution with the SDAT, all shares of our common stock owned by you will be cancelled.

Yes, some of our directors and officers and the Advisor and its affiliates may have interests in the liquidation that are different from your interests as a stockholder, including the following:

- All of our executive officers, including Messrs. Schreiber and Waldvogel and Ms. Yamane, are officers of the Advisor and/or one or more of the Advisor’s affiliates and are compensated by those entities, in part, for their service rendered to us. We currently do not pay any direct compensation to our executive officers. Mr. Schreiber is also one of our directors.

- Pursuant to the terms of the advisory agreement, the Advisor is expected to be entitled to disposition fees in connection with the sale of our properties. These disposition fees, including fees for the sale of the Campus Drive Buildings, are estimated to be between approximately $10.3 million and $11.1 million, depending upon the prices we receive for the sale of our properties. See “Proposal One – The Plan of Liquidation Proposal – Use of Liquidation Proceeds” in the proxy statement.

- The Advisor earns asset management fees from us and receives reimbursement of certain of its operating costs. The Advisor will continue to earn such fees and receive reimbursements as long as we continue to own any properties, and the Advisor will receive reimbursements for expenses until our liquidation and dissolution are complete. Based on the properties we owned as of the date of the proxy statement, excluding the Campus Drive Buildings which are under contract to sell as of the date of the proxy statement, we project that we may pay the Advisor an aggregate of approximately $7.6 million for asset management fees and reimbursement of certain of its operating expenses in 2020 and 2021 during the liquidation process, although this estimate may vary significantly based on the timing of property sales.

- The Advisor owns a total of 20,000 shares of our common stock, for which we estimate it will receive liquidating distributions of between approximately $68,000 and $76,600 in connection with our liquidation.

- Not including the 20,000 shares owned by the Advisor referenced above, one of our directors owns an aggregate of 2,680 shares of our common stock, for which we estimate he will receive aggregate liquidating distributions of between approximately $9,112 and $10,264 in connection with our liquidation.

Consequently, some of our directors and officers and the Advisor, in some instances, may be more motivated to support the Plan of Liquidation than might otherwise be the case if they did not expect to receive those payments. Additionally, because of the above conflicts of interest, some of our directors and officers and the Advisor may be motivated to make decisions or take actions based on factors other than the best interest of our stockholders throughout the liquidation process. The board of directors and the Special Committee each was aware of these interests and considered them in making their recommendations. For further information regarding interests that differ from your interests please see “Proposal 1. The Plan of Liquidation Proposal – Interests in the Plan of Liquidation that Differ from Your Interests” in the proxy statement.

Yes. You should carefully review the section of the proxy statement entitled “Risk Factors.”

Subject to the limitations, assumptions, and qualifications described in the proxy statement and the approval by our stockholders of the Plan of Liquidation, the intended liquidation and dissolution of the Company pursuant to the Plan of Liquidation will constitute a taxable distribution to you in redemption of your ownership of our common stock, with the following material federal income tax consequences to our stockholders.

In general, if the Plan of Liquidation is approved and we are liquidated, you will realize, for U.S. federal income tax purposes, gain or loss equal to the difference between the cash distributed to you by the Company and your adjusted tax basis in our common stock. Note that any loss inherent in your common stock would not be recognizable until the final liquidating distribution is made, which would likely be during the 2022 taxable year. If we distribute beneficial interests in a liquidating trust (as defined in the section entitled “Material United States Federal Income Tax Consequences” in the proxy statement) to you, you would be required to recognize any gain in the taxable year of the distribution of the liquidating trust beneficial interests (to the extent that you have not recognized such gain in prior taxable years), although you may not receive the cash necessary to pay the tax on such gain. If you receive cash from the liquidating trust, you may receive such cash after the due date for filing your tax return and paying the tax on such gain. Distributions of beneficial interests in the liquidating trust will also constitute a final liquidating distribution that should allow the recognition of any loss. A summary of the possible tax consequences to you is included in “Material United States Federal Income Tax Consequences” in the proxy statement.

YOU ARE URGED TO CONSULT YOUR OWN TAX ADVISOR AS TO THE SPECIFIC TAX CONSEQUENCES TO YOU OF THE TRANSACTIONS DESCRIBED IN THE PROXY STATEMENT, INCLUDING THE APPLICABLE FEDERAL, STATE, LOCAL, AND FOREIGN TAX CONSEQUENCES OF SUCH TRANSACTIONS.