KBS Growth & Income REIT, Inc.

Annual Meeting of Stockholders

The annual meeting of stockholders for KBS Growth & Income REIT is as follows:

01

Date and Time

Wednesday, March 10, 2021 at 12:00 p.m. (Pacific)

02

The Offices of KBS

7th Floor Boardroom

800 Newport Center Drive

Newport Beach, CA 92660

For Proxy Related Questions

For questions regarding your proxy vote, or for assistance with your proxy materials, please contact Broadridge Financial Solutions, Inc. at: (888) 777-1346.

Representatives are available Monday to Friday 9:00 a.m. to 9:00 p.m. (Eastern).

Thank You

KBS Growth & Income REIT Investor Relations

The Purpose

Why is this happening

01

Liquidation Proposal

To approve a plan of complete liquidation and dissolution of KBS Real Estate Investment Trust II, Inc. (the “Plan of Liquidation”).

02

Charter Amendment Proposals

To approve four separate amendments to the company’s charter.

03

Elect Directors

To elect four directors to hold office for one-year terms.

04

Ernst & Young LLP

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019.

05

Adjournment Proposal

To vote on a proposal that would permit KBS Real Estate Investment Trust II, Inc to proceed with the voting on and approval of only the proposals that have received sufficient votes to be approved at the annual meeting, “the Adjournment Proposal”.

REIT II

Equity Assets

Est. Value of Current Portfolio

As of Dec. 2019

$1.08 Billion

Est. Value Per Share

As of Nov. 2019

$3.79

100 & 200 Campus Drive Buildings

Florham Park, New Jersey

2 Office Buildings

590,458 sf

Sep 9, 2008

99%

$180,700,000

82%

As of March 31, 2019

As of March 31, 2019

300 - 600 Campus Drive Buildings

Florham Park, New Jersey

4 Office Buildings

578,388 sf

Oct 10, 2008

100%

$184,300,000

94%

As of March 31, 2019

As of March 31, 2019

Willow Oaks Corporate Center

Fairfax, Virginia

3 Office Buildings

584,003 sf

Aug 26, 2009

94%

$112,174,000

53%

As of March 31, 2019

As of March 31, 2019

Union Bank Plaza

Fairfax, Virginia

1 Office Building

701,888 sf

Sep 15, 2010

96%

$208,000,000

82%

As of March 31, 2019

As of March 31, 2019

Granite Tower

Denver, Colorado

1 Office Building

591,070 sf

Dec 16, 2010

96%

$149,000,000

96%

As of March 31, 2019

As of March 31, 2019

Fountainhead Plaza

Tempe, Arizona

2 Office Buildings

445,957 sf

Sep 13, 2011

100%

$137,000,000

100%

As of March 31, 2019

As of March 31, 2019

Corporate Technology Centre

San Jose, California

5 Office Buildings

415,700 sf

Mar 28, 2013

100%

$163,000,000

18%

As of March 31, 2019

As of March 31, 2019

Your Vote Matters

Your vote is very important

KBS Real Estate Investment Trust II, Inc. cannot complete the sale of its properties pursuant to the terms of the Plan of Liquidation without majority stockholder approval. Stockholder approval is needed to ensure that the proposals described in the proxy statement can be acted upon.

Your vote makes a difference

You are entitled to one vote for each share of common stock you held as of the record date.

Stockholders are encouraged to vote as early as possible to help avoid delays and additional expenses associated with soliciting stockholder votes.

Board recommendation

The KBS Real Estate Investment Trust II, Inc. board of directors recommends that stockholders vote FOR all proposals described in the voter proxy card.

NExt Steps

What do I need to do?

Stockholders can vote in person at the annual meeting. However, if you’re not attending, you have three options to submit your vote by proxy:

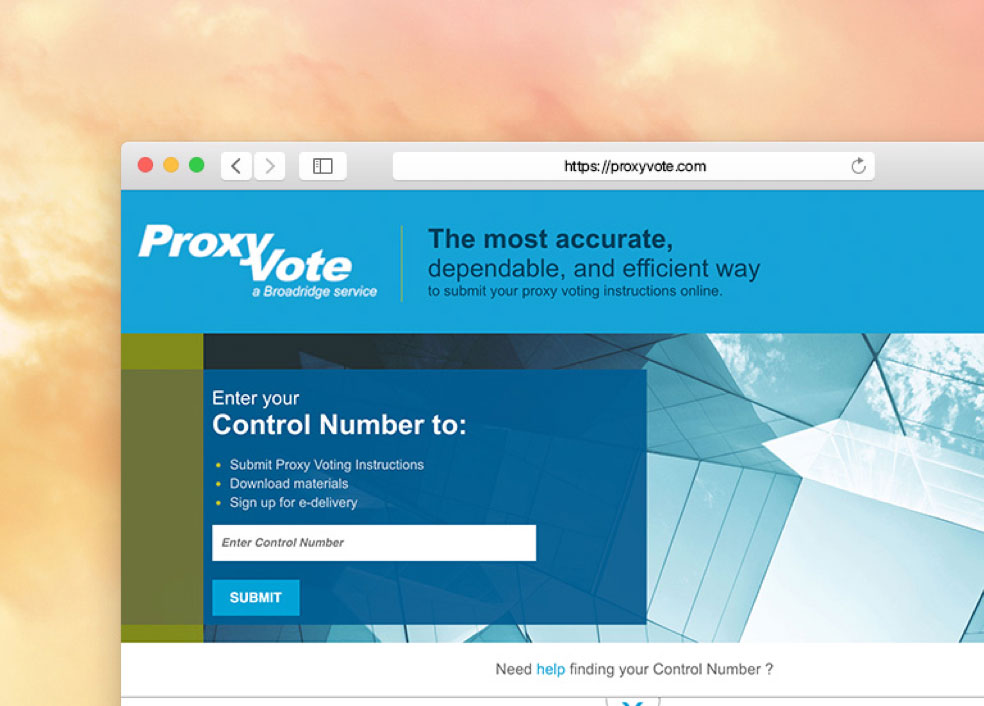

1. Online

Please have your proxy card in hand when accessing the website. There are easy-to-follow directions to help you complete the electronic voting instruction form.

proxyvote.com

OR

2. Phone

Call 1-800-690-6903 with a touch-tone phone to vote using an automated system.

3. Mail

Complete, sign, date and return the enclosed proxy card in the pre-paid envelope provided.

Questions & Answers

Questions about Annual Meeting and Voting

Questions about Plan of Liquidation Proposal

We sent you the proxy statement and the proxy card because the board of directors is soliciting your proxy to vote your shares at the Company’s annual meeting of stockholders. You owned shares of record of our common stock at the close of business on December 6, 2019, the record date for the annual meeting, and, therefore, are entitled to vote at the annual meeting. The proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and is designed to assist you in voting. You do not need to attend the annual meeting in person in order to vote.

Anyone who is a stockholder of record at the close of business on December 6, 2019, the record date for the annual meeting, or holds a valid proxy for the annual meeting, is entitled to vote at the annual meeting. In order to be admitted to the annual meeting, you must present proof of ownership of our stock on the record date. Such proof can consist of: a brokerage statement or letter from a broker indicating ownership on December 6, 2019; a proxy card; a voting instruction form; or a legal proxy provided by your broker or nominee. Any holder of a proxy from a stockholder must present the proxy card, properly executed, and a copy of the proof of ownership.

Note that our external advisor, KBS Capital Advisors LLC (the “Advisor”), which owned 20,000 shares of our common stock as of the record date, has agreed to abstain from voting any shares it owns in any vote for the election of directors.

A proxy is a person who votes the shares of stock of another person who could not attend a meeting. The term “proxy” also refers to the proxy card or other method of appointing a proxy. When you submit your proxy, you are appointing Charles J. Schreiber, Jr., Jeffrey K. Waldvogel and Stacie K. Yamane, each of whom is one of our executive officers, as your proxies, and you are giving them permission to vote your shares of common stock at the annual meeting. The appointed proxies will vote your shares of common stock as you instruct, unless you submit your proxy without instructions.

If you submit your proxy without instructions, they will vote:

- FOR the proposed plan of complete liquidation and dissolution of the Company, as more fully described in the proxy statement (the “Plan of Liquidation”). The proposal relating to the Plan of Liquidation is referred to herein as the “Plan of Liquidation Proposal.”

- FOR each of the four amendments to our charter, which consist of:

- an amendment to eliminate (i) conditions and limitations on our exculpation and indemnification of our present or former directors and the Advisor and its affiliates and (ii) limitations on our ability to reimburse our present or former directors and the Advisor or its affiliates for reasonable legal expenses and other costs, each of which had previously been required by state securities administrators in connection with our initial public offering. Instead, the proposed amendment provides that we shall exculpate and indemnify our present and former directors and officers to the maximum extent permitted by Maryland law and provides us the ability to exculpate and indemnify the Advisor and its affiliates pursuant to the terms of the advisory agreement (the “Indemnification Proposal”),

- an amendment to eliminate the charter requirement to distribute a specific report with audited financial statements, related-party and other information to stockholders each year, that had previously been required by state securities administrators in connection with our initial public offering (the “Reporting Proposal”). Although the charter would no longer require us to provide audited financial statements to our stockholders, any decision by the Company to cease providing audited financial statements to our stockholders would require that the SEC grant us relief from certain reporting requirements under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”),

- an amendment to exclude the distribution of interests in a liquidating trust from the definition of a “roll-up transaction” (the “Roll-Up Definition Proposal”), and

- an amendment to eliminate the current charter limit on “total operating expenses” (as defined in the charter) to amounts that do not exceed the greater of 2% of the Company’s “average invested assets” (as defined in the charter) or 25% of the Company’s “net income” (as defined in the charter) for the four consecutive fiscal quarters then ended unless the Company’s conflicts committee has made a finding that, based on unusual and non-recurring factors that it deems sufficient, a higher level of expenses is justified (the “Operating Expenses Proposal” and, together with the Indemnification Proposal, the Reporting Proposal and the Roll-Up Definition Proposal, the “charter Amendment Proposals”). This charter limit had previously been required by state securities administrators in connection with our initial public offering.

- FOR all of the director nominees,

- FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019, and

- FOR a proposal that would permit us (a) to proceed with the voting on and approval of only the proposals that have received sufficient votes to be approved at the annual meeting, and (b) subsequently, to adjourn the annual meeting to solicit additional proxies to vote in favor of any proposal that has not received sufficient votes to be approved at the annual meeting (the “Adjournment Proposal”).

With respect to any other proposals to be voted upon, the appointed proxies will vote in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion. It is important for you to submit your proxy via the Internet, by telephone or return the proxy card to us as soon as possible, whether or not you plan on attending the annual meeting.

The annual meeting will be held on Thursday, March 5, 2020, at 8:30 am Pacific, at the offices of KBS, 800 Newport Center Drive, First Floor, Suite 140 Conference Center, Newport Beach, California 92660.

Yes. Your vote could affect the proposals described in the proxy statement. Moreover, your vote is needed to ensure that the proposals described in the proxy statement can be acted upon. Because we are a widely held company, your vote is VERY IMPORTANT! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

As of December 6, 2019, there were 185,385,202 shares of our common stock issued and outstanding and entitled to be cast at the annual meeting. However, as stated above, the Advisor has agreed to abstain from voting any shares it owns in any vote for the election of directors.

A quorum consists of the presence in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast at the annual meeting. There must be a quorum present in order for the annual meeting to be a duly held meeting at which business can be conducted. No business may be conducted at the annual meeting if a quorum is not present. If you submit your proxy, even if you abstain from voting, then you will still be considered part of the quorum.

If a quorum is not present at the annual meeting, the chairman of the meeting may adjourn the annual meeting to another date, time or place, not later than 120 days after the original record date of December 6, 2019. Notice need not be given of the new date, time or place if announced at the annual meeting before an adjournment is taken.

You are entitled to one vote for each share of common stock you held as of the record date.

You may vote on each of the following proposals:

- Proposal 1: the Plan of Liquidation Proposal;

- Proposal 2: each of the four charter Amendment Proposals;

- Proposal 3: the election of the nominees to serve on the board of directors;

- Proposal 4: the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019; and

- Proposal 5: the Adjournment Proposal.

In addition, you may vote on such other business as may properly come before the annual meeting and any adjournment or postponement thereof.

The board of directors recommends that you vote:

- FOR the Plan of Liquidation Proposal;

- FOR each of the four charter Amendment Proposals;

- FOR each of the nominees for election as director who is named in the proxy statement;

- FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019; and

- FOR the Adjournment Proposal.

The affirmative vote of a majority of all of the shares of common stock entitled to vote on the Plan of Liquidation Proposal is required for approval of the Plan of Liquidation Proposal. Because of this majority vote requirement, “ABSTAIN” votes and broker non-votes (discussed below) will have the effect of a vote against the Plan of Liquidation Proposal. If you submit a proxy card with no further instructions, your shares will be voted FOR the Plan of Liquidation Proposal.

The affirmative vote of a majority of all of the shares of common stock entitled to vote on each of the charter Amendment Proposals is required for approval of that respective proposal. Because of this majority vote requirement, “ABSTAIN” votes and broker non-votes will have the effect of a vote against each of the charter Amendment Proposals. If you submit a proxy card with no further instructions, your shares will be voted FOR each of the charter Amendment Proposals.

A majority of the shares of common stock present in person or by proxy at an annual meeting at which a quorum is present is required for the election of the directors. This means that, of the shares of common stock present in person or by proxy at an annual meeting, a director nominee needs to receive affirmative votes from a majority of such shares in order to be elected to the board of directors. Because of this majority vote requirement, “withhold” votes and broker non-votes will have the effect of a vote against each nominee for director. If an incumbent director nominee fails to receive the required number of votes for re-election, then under Maryland law, he or she will continue to serve as a “holdover” director until his or her successor is duly elected and qualified. If you submit a proxy card with no further instructions, your shares will be voted FOR each of the nominees.

A majority of the votes cast at an annual meeting at which a quorum is present is required for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019. Abstentions will not count as votes actually cast with respect to determining if a majority vote is obtained under our bylaws and will have no effect on the determination of this proposal. Your shares may be voted for this proposal if they are held in the name of a brokerage firm even if you do not provide the brokerage firm with voting instructions. If you submit a proxy card with no further instructions, your shares will be voted FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019.

A majority of the votes cast at an annual meeting at which a quorum is present is required for the approval of the Adjournment Proposal. Abstentions and broker non-votes will not affect the outcome of this proposal. If you submit a proxy card with no further instructions, your shares will be voted FOR the Adjournment Proposal.

Stockholders can vote in person at the annual meeting, as described above under “Who is entitled to vote at the annual meeting?”, or by proxy. Stockholders have the following three options for submitting their votes by proxy:

- via the Internet, by accessing the website and following the instructions indicated on the proxy card;

- by telephone, by calling the telephone number and following the instructions indicated on the proxy card; or

- by mail, by completing, signing, dating and returning the proxy card.

A “broker non-vote” occurs when a broker holding stock on behalf of a beneficial owner submits a proxy but does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that particular proposal and has not received instructions from the beneficial owner. Brokers are precluded from exercising their voting discretion with respect to the approval of non-routine matters, such as the approval of the Plan of Liquidation Proposal and, as a result, absent specific instructions from the beneficial owner of such shares, brokers will not vote those shares. Broker non-votes will be considered as “present” for purposes of determining a quorum. Broker non-votes will have the effect of a vote AGAINST the Plan of Liquidation Proposal, AGAINST each of the charter Amendment Proposals and AGAINST the election of each nominee for director but will have no effect on the Adjournment Proposal. Because brokers have discretionary authority to vote for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, in the event they do not receive voting instructions from the beneficial owner of the shares, there will not be any broker non-votes with respect to that proposal.

Your broker will send you information to instruct it on how to vote on your behalf. If you do not receive a voting instruction card from your broker, please contact your broker promptly to obtain a voting instruction card. Your vote is important to the success of the proposals. We encourage all of our stockholders whose shares are held by a broker to provide their brokers with instructions on how to vote.

Although we do not know of any business to be considered at the annual meeting other than the Plan of Liquidation Proposal, the charter Amendment Proposals, the election of directors, the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2019 and the Adjournment Proposal, if any other business is properly presented at the annual meeting, your submitted proxy gives authority to Messrs. Schreiber and Waldvogel and Ms. Yamane, and each of them, to vote on such matters in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion.

You have the right to revoke your proxy at any time before the annual meeting by:

(1) notifying Mr. Waldvogel, our Secretary;

(2) attending the annual meeting and voting in person as described above under “Who is entitled to vote at the annual meeting?”;

(3) returning another proxy card dated after your first proxy card, if we receive it before the annual meeting date; or

(4) recasting your proxy vote via the Internet or by telephone.

Only the most recent proxy vote will be counted and all others will be discarded regardless of the method of voting. If a broker or other nominee holds your stock on your behalf, you must contact your broker, bank or other nominee to change your vote.

Any proposals by stockholders for inclusion in our proxy solicitation material for the next annual meeting of stockholders must be received by our Secretary, Mr. Waldvogel, at our executive offices no later than August 18, 2020. However, if we hold the next annual meeting before February 3, 2021 or after April 4, 2021, stockholders must submit proposals for inclusion in our proxy statement within a reasonable time before we begin to print our proxy materials. The mailing address of our executive offices is 800 Newport Center Drive, Suite 700, Newport Beach, California 92660. If a stockholder wishes to present a proposal at the next annual meeting, whether or not the proposal is intended to be included in our proxy materials, our bylaws require that the stockholder give advance written notice to our Secretary by September 17, 2020.

In addition to mailing proxy solicitation materials, our directors and employees of the Advisor or its affiliates may also solicit proxies in person, via the Internet, by telephone or by any other electronic means of communication we deem appropriate. Additionally, we have retained Broadridge Financial Solutions, Inc. (“Broadridge”), a proxy solicitation firm, to assist us in the proxy solicitation process. If you need any assistance, or have any questions regarding the proposals or how to cast your vote, you may contact Broadridge at 844-858-7384.

Our directors and employees of the Advisor or its affiliates will not be paid any additional compensation for soliciting proxies. We will pay all of the costs of soliciting these proxies, including the cost of Broadridge’s services. We anticipate that for Broadridge’s solicitation services we will pay approximately $84,500, plus reimbursement of Broadridge’s out-of-pocket expenses. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to you.

You may receive more than one set of voting materials for the annual meeting, including multiple copies of the proxy statement and multiple proxy cards or voting instruction forms. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction form for each brokerage account in which you hold shares. If you are a holder of record and your shares are registered in more than one name, you will receive more than one proxy card and voting instruction form. For each and every proxy card and voting instruction form that you receive, please authorize a proxy as soon as possible using one of the following methods:

- via the Internet, by accessing the website and following the instructions indicated on the proxy card;

- by telephone, by calling the telephone number and following the instructions indicated on the proxy card; or

- by mail, by completing, signing, dating and returning the proxy card.

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the proxy statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of the proxy statement to you if you contact Broadridge at 844-858-7384.

We will file a Current Report on Form 8-K within four business days after the annual meeting to announce voting results. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

Additional information about us can be obtained from the various sources described under “Where You Can Find More Information” in the proxy statement.

Adjourning the annual meeting to a later date will give us additional time to solicit proxies to vote in favor of any proposal that has not received sufficient votes to be approved at the annual meeting. Consequently, we are seeking your approval of the Adjournment Proposal to permit us (i) to proceed with the voting on and approval of only the proposals that have received sufficient votes to be approved at the annual meeting, and (ii) subsequently, to adjourn the annual meeting to solicit additional proxies to vote in favor of any proposal that has not received sufficient votes to be approved at the annual meeting.

If you have any questions about the annual meeting, the Plan of Liquidation Proposal, any of the charter Amendment Proposals, the election of directors, the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm or the Adjournment Proposal, how to submit your proxy, or if you need additional copies of the proxy statement or the proxy card or voting instructions, you should contact Broadridge.

Broadridge Financial Solutions, Inc.

1-844-858-7384

Our shares are illiquid and nearly all of our stockholders have held their stock for between nine and eleven years. As disclosed in the registration statement for our initial public offering, the charter required that we seek stockholder approval of our liquidation if our shares of common stock were not listed on a national securities exchange by March 2018, unless a majority of our conflicts committee determined that liquidation was not then in the best interest of our stockholders. The charter requires that the conflicts committee revisit the issue of liquidation at least annually. In March 2018 and in March 2019, the conflicts committee determined that liquidation was not then in the best interest of our stockholders.

On January 27, 2016, our board of directors formed a special committee (the “Special Committee”) composed of all of our independent directors to explore the availability of strategic alternatives involving us. As part of the process of exploring strategic alternatives, on February 23, 2016, the Special Committee engaged Evercore Group L.L.C. (“Evercore”) to act as our financial advisor and to assist us and the Special Committee with this process. Under the terms of the engagement, Evercore provided various financial advisory services, as requested by the Special Committee as customary for an engagement in connection with exploring strategic alternatives. Although the Special Committee engaged Evercore to assist us and the Special Committee with the exploration of strategic alternatives for us, we were not obligated to enter into any particular transaction or any transaction at all.

Following a review of the strategic alternatives presented by Evercore, in May 2016 we announced the determination of the Special Committee that it would be in our best interest and the best interest of our stockholders to market for sale the Company’s assets while it continued to explore strategic alternatives for us. Subsequent to that time, our Advisor recommended to the Special Committee and our board of directors that it would be in the best interest of our stockholders for the Company to market for sale and, if satisfactory prices were obtained, sell those of our properties that our Advisor believed were best positioned for sale in the near term, while continuing to operate the remainder of our portfolio with a view toward making the necessary enhancements to best position the remaining assets in our portfolio for sale. Those enhancements included addressing key lease expirations for certain of our remaining assets as well as executing on those capital projects recommended by our Advisor for our remaining assets.

As noted above, in each of March 2018 and 2019, our conflicts committee determined that liquidation was not then in the best interest of our stockholders. However, because of developments over the past six months with respect to the execution of several key leases and completion of capital projects that enhance property stability and better position our remaining assets for sale, on November 8, 2019, the Advisor discussed its detailed analysis of the state of and future outlook for the Company’s portfolio with the board of directors and the Special Committee, and our Advisor recommended to the board of directors and the Special Committee that it would be in our best interest and the best interest of our stockholders to engage in a planned liquidation pursuant to the Plan of Liquidation. The board of directors and the Special Committee carefully reviewed and considered the terms and conditions of the Plan of Liquidation and the transactions contemplated by that plan, as well as the other alternatives described in the proxy statement, and the Special Committee consulted with Evercore regarding Evercore’s view of the Company’s assets as well as its view of the Company’s other strategic alternatives, including a merger of the Company with another entity, a sale of the Company, a sale of the Company’s portfolio in a single transaction or a listing of the Company on a national securities exchange. See “What alternatives to the Plan of Liquidation have you considered?” below for a discussion of other alternatives considered.

On November 13, 2019, the board of directors and the Special Committee each concluded that a planned liquidation pursuant to the Plan of Liquidation was in the Company’s best interest and the best interest of our stockholders, and each unanimously determined that the terms of the Plan of Liquidation are fair to you, advisable and in your best interest. For a discussion of the reasons for the Plan of Liquidation, see “Proposal 1. The Plan of Liquidation Proposal – Reasons for the Plan of Liquidation Proposal; Recommendation of the Board of Directors and the Special Committee” in the proxy statement. The board of directors and the Special Committee then decided to seek your approval of the Plan of Liquidation. We currently estimate that if the Plan of Liquidation Proposal is approved by our stockholders and we are able to successfully implement the plan, our net proceeds from liquidation and, therefore, the amount of cash that you would receive for each share of our common stock that you then hold, could range between approximately $3.40 and $3.83 per share. We note that we previously paid (i) a special distribution in the amount of $4.50 per share to stockholders of record as of the close of business on September 15, 2014 and (ii) a special distribution of $0.45 per share to stockholders of record as of the close of business on June 17, 2019, all in connection with asset sales.

Our range of estimated net proceeds from liquidation is based upon market, economic, financial and other circumstances and conditions existing as of the date of the proxy statement, and any changes in such circumstances and conditions during the liquidation process could have a material effect on the ultimate amount of liquidating distributions received by stockholders.

We cannot complete the sale of all of our assets or our dissolution pursuant to the terms of the Plan of Liquidation unless our stockholders approve the Plan of Liquidation Proposal. If the Plan of Liquidation Proposal is not approved by our stockholders, the board of directors will meet to determine what other alternatives to pursue in the best interest of the Company and our stockholders, including, without limitation, continuing to operate under our current business plan. If the Plan of Liquidation is approved by our stockholders, we intend to pay the initial liquidating distribution within two months of stockholder approval, with such distribution to be funded with the proceeds from the sale of the Campus Drive Buildings. If the Plan of Liquidation Proposal is not approved, the board of directors will consider the best uses of the proceeds from such asset sale, which uses may include paying a special distribution to our stockholders, continuing to pay down debt, paying for capital expenditures related to certain of our real estate properties to reposition such properties or acquiring additional real estate assets.

The board of directors and the Special Committee also explored the options of:

- continuing under our current business plan; and

- seeking to dispose of our assets through a merger or a portfolio or whole-entity sale.

The board of directors and the Special Committee also considered a listing of our common stock on a national securities exchange. However, after consulting with Evercore and the Advisor, the board of directors and the Special Committee each concluded that because of the nature of the Company’s portfolio of properties, along with our externalized management structure, it would not be worthwhile to devote meaningful time or resources to evaluating a possible listing of our shares on a national securities exchange.

If we continue to operate under our current business plan, we may experience a decrease in cash flow due to the fixed costs associated with running a public REIT, asset sales and the costs of maintaining our properties. In this event, we may need to further revise our distribution policy.

After reviewing the other alternatives, and based on developments in the portfolio over the past six months with respect to key lease executions and the completion of certain capital projects that enhance property stability and better position our remaining assets for sale, the board of directors and the Special Committee concluded that a planned liquidation pursuant to the Plan of Liquidation was in the Company’s best interest and the best interest of our stockholders. For additional information on the board of directors’ and the Special Committee’s analysis of other strategic alternatives, see “Proposal 1. The Plan of Liquidation Proposal – Background of the Plan of Liquidation – Assessment of Strategic Alternatives” in the proxy statement.

Pursuant to Maryland law and the charter, you are not entitled to appraisal or dissenters rights (or rights of an objecting stockholder) in connection with the Plan of Liquidation.

The Plan of Liquidation authorizes us to undertake an orderly liquidation. In an orderly liquidation, we would sell all of our assets, pay all of our known liabilities, provide for the payment of our unknown or contingent liabilities, distribute our remaining cash to our stockholders, wind up our operations and dissolve.

In order to dissolve, we will file articles of dissolution (“Articles of Dissolution”) with the State Department of Assessments and Taxation of Maryland (the “SDAT”), our jurisdiction of incorporation, to dissolve the Company as a legal entity following the satisfaction of or provision for all our outstanding liabilities. The board of directors, in its sole discretion, will determine the timing for this filing. We expect to pay liquidating distributions to our stockholders during the liquidation process and to pay the final liquidating distribution after we sell all of our assets, pay or provide for all of our known liabilities and provide for unknown liabilities. We expect to complete these activities within 24 months after stockholder approval of the Plan of Liquidation. A final liquidating distribution to our stockholders may not be paid until all of our liabilities have been satisfied. Upon our liquidation and dissolution, the Company will cease to exist.

The Plan of Liquidation provides, in pertinent part, that, among other things:

- We will be authorized to sell all of our assets (including, if appropriate, through a whole-entity sale or sale of one or more of our subsidiaries or our direct or indirect ownership interests in these subsidiaries), liquidate and dissolve the Company, and distribute the net proceeds from liquidation in accordance with the provisions of the charter and applicable law. Although we currently anticipate that we will sell our assets for cash and our discussion in the proxy statement contemplates that we will receive cash for the sale of our assets, the Plan of Liquidation provides that our assets may be sold for cash, notes or such other assets as may be conveniently liquidated or distributed to our stockholders.

- We will be authorized to take all necessary or advisable actions to wind up our business, pay our debts, and distribute the remaining proceeds to our stockholders.

- We will be authorized to provide for the payment of any unascertained or contingent liabilities. We may do so by purchasing insurance, by establishing a reserve fund or in other ways.

- We expect to distribute all of the net proceeds from liquidation to you within 24 months after the date the Plan of Liquidation is approved by our stockholders. However, if we cannot sell our assets and pay our debts within 24 months, or if the board of directors and the Special Committee determine that it is otherwise advisable to do so, we may transfer and assign our remaining assets to a liquidating trust. Upon such transfer and assignment, our stockholders will receive beneficial interests in the liquidating trust. The liquidating trust will pay or provide for all of our liabilities and distribute any remaining net proceeds from liquidation to the holders of beneficial interests in the liquidating trust. The amounts that you would receive from the liquidating trust are included in our estimates described above of the total amount of cash that you will receive in the liquidation.

- Prior to the acceptance for record of the Articles of Dissolution by the SDAT, the board of directors may terminate the Plan of Liquidation for any reason, subject to and contingent upon the approval of such termination by our stockholders. Notwithstanding approval of the Plan of Liquidation by our stockholders, the board of directors or, if a liquidating trust is established, the trustees of the liquidating trust, may make certain modifications or amendments to the Plan of Liquidation without further action by or approval of our stockholders to the extent permitted under law.

- Upon our liquidation and dissolution, all of our outstanding shares of stock will be cancelled and the Company will cease to exist.

For more information, see “Proposal 1: The Plan of Liquidation Proposal” in the proxy statement.

As of the date of the proxy statement, we have entered into an agreement to sell the Campus Drive Buildings. For more information, see “Our Business and Assets” in the proxy statement. There can be no assurance that this disposition will close on the projected closing date or at all, or that the Campus Drive Buildings will sell for the projected sales price. In addition, this disposition is not contingent on stockholder approval of the Plan of Liquidation Proposal. The anticipated net proceeds from this sale are included in the range of estimated net proceeds from liquidation discussed in the proxy statement.

The amount of cash that may ultimately be received by our stockholders is not yet known. However, we currently estimate that if the Plan of Liquidation Proposal is approved by our stockholders and we are able to successfully implement the plan, our net proceeds from liquidation and, therefore, the amount of cash that you would receive for each share of our common stock that you then hold, could range between approximately $3.40 and $3.83 per share. We note that we previously paid (i) a special distribution in the amount of $4.50 per share to stockholders of record as of the close of business on September 15, 2014 and (ii) a special distribution of $0.45 per share to stockholders of record as of the close of business on June 17, 2019, all in connection with asset sales. There are many factors that may affect the amount of liquidating distributions available for distribution to our stockholders, including, among other factors: (i) the ultimate sale price of each asset, (ii) changes in market demand that affect the timing of the disposition of office properties during the liquidation process, (iii) the amount of taxes, transaction fees and expenses relating to the Plan of Liquidation, and (iv) amounts needed to pay or provide for our liabilities and expenses, including unanticipated or contingent liabilities that could arise. No assurance can be given as to the amount of liquidating distributions you will ultimately receive. If we have underestimated our existing obligations and liabilities or if unanticipated or contingent liabilities arise, the amount ultimately distributed to our stockholders could be less than that set forth above. In addition, these estimates are based upon market, economic, financial and other circumstances and conditions existing as of the date of the proxy statement, and any changes in such circumstances and conditions during the liquidation process could have a material effect on the ultimate amount of liquidating distributions received by our stockholders. See “Risk Factors” and “Proposal 1: The Plan of Liquidation Proposal – Background of the Plan of Liquidation” in the proxy statement.

If the Plan of Liquidation is approved by our stockholders, we intend to pay the initial liquidating distribution within two months of stockholder approval, with such distribution to be funded with the proceeds from the sale of the Campus Drive Buildings. We expect to pay multiple liquidating distribution payments to our stockholders during the liquidation process and to pay the final liquidating distribution after we sell all of our properties, pay all of our known liabilities and provide for unknown liabilities. We expect to complete these activities within 24 months after stockholder approval of the Plan of Liquidation. If we have not sold all of our properties and paid all of our liabilities within 24 months after stockholder approval of the Plan of Liquidation, or if the board of directors and the Special Committee otherwise determine that it is advantageous to do so, we may transfer our remaining assets and liabilities to a liquidating trust. We would then distribute beneficial interests in the liquidating trust to our stockholders. If we establish a reserve fund, we may pay a final distribution from any funds remaining in the reserve fund after we determine that all of our liabilities have been paid.

The actual amounts and timing of the liquidating distributions will be determined by the board of directors or, if a liquidating trust is formed, by the trustees of the liquidating trust, in their discretion. If you transfer your shares during the liquidation process, the right to receive liquidating distributions will transfer with those shares.

A liquidating trust is a trust organized for the primary purpose of liquidating and distributing the assets transferred to it. If we form a liquidating trust, we will transfer to our stockholders beneficial interests in the liquidating trust. This transfer of beneficial interests will constitute a taxable distribution to you in redemption of your ownership of our common stock. Beneficial interests in the liquidating trust will generally not be transferable by you.

In connection with the approval of the Plan of Liquidation by our board of directors, our board of directors determined to cease paying regular monthly distributions. Going forward we expect to satisfy the REIT distribution requirements through the payment of liquidating distributions. Every payment of distributions will be subject to the availability of cash and the discretion of the board of directors.

If our stockholders approve the Plan of Liquidation Proposal, after we have sold all of our assets, satisfied our liabilities, paid our final liquidating distribution to our stockholders and filed the Articles of Dissolution with the SDAT, all shares of our common stock owned by you will be cancelled.

Yes, some of our directors and officers and the Advisor and its affiliates may have interests in the liquidation that are different from your interests as a stockholder, including the following:

- All of our executive officers, including Messrs. Schreiber and Waldvogel and Ms. Yamane, are officers of the Advisor and/or one or more of the Advisor’s affiliates and are compensated by those entities, in part, for their service rendered to us. We currently do not pay any direct compensation to our executive officers. Mr. Schreiber is also one of our directors.

- Pursuant to the terms of the advisory agreement, the Advisor is expected to be entitled to disposition fees in connection with the sale of our properties. These disposition fees, including fees for the sale of the Campus Drive Buildings, are estimated to be between approximately $10.3 million and $11.1 million, depending upon the prices we receive for the sale of our properties. See “Proposal One – The Plan of Liquidation Proposal – Use of Liquidation Proceeds” in the proxy statement.

- The Advisor earns asset management fees from us and receives reimbursement of certain of its operating costs. The Advisor will continue to earn such fees and receive reimbursements as long as we continue to own any properties, and the Advisor will receive reimbursements for expenses until our liquidation and dissolution are complete. Based on the properties we owned as of the date of the proxy statement, excluding the Campus Drive Buildings which are under contract to sell as of the date of the proxy statement, we project that we may pay the Advisor an aggregate of approximately $7.6 million for asset management fees and reimbursement of certain of its operating expenses in 2020 and 2021 during the liquidation process, although this estimate may vary significantly based on the timing of property sales.

- The Advisor owns a total of 20,000 shares of our common stock, for which we estimate it will receive liquidating distributions of between approximately $68,000 and $76,600 in connection with our liquidation.

- Not including the 20,000 shares owned by the Advisor referenced above, one of our directors owns an aggregate of 2,680 shares of our common stock, for which we estimate he will receive aggregate liquidating distributions of between approximately $9,112 and $10,264 in connection with our liquidation.

Consequently, some of our directors and officers and the Advisor, in some instances, may be more motivated to support the Plan of Liquidation than might otherwise be the case if they did not expect to receive those payments. Additionally, because of the above conflicts of interest, some of our directors and officers and the Advisor may be motivated to make decisions or take actions based on factors other than the best interest of our stockholders throughout the liquidation process. The board of directors and the Special Committee each was aware of these interests and considered them in making their recommendations. For further information regarding interests that differ from your interests please see “Proposal 1. The Plan of Liquidation Proposal – Interests in the Plan of Liquidation that Differ from Your Interests” in the proxy statement.

Yes. You should carefully review the section of the proxy statement entitled “Risk Factors.”

Subject to the limitations, assumptions, and qualifications described in the proxy statement and the approval by our stockholders of the Plan of Liquidation, the intended liquidation and dissolution of the Company pursuant to the Plan of Liquidation will constitute a taxable distribution to you in redemption of your ownership of our common stock, with the following material federal income tax consequences to our stockholders.

In general, if the Plan of Liquidation is approved and we are liquidated, you will realize, for U.S. federal income tax purposes, gain or loss equal to the difference between the cash distributed to you by the Company and your adjusted tax basis in our common stock. Note that any loss inherent in your common stock would not be recognizable until the final liquidating distribution is made, which would likely be during the 2022 taxable year. If we distribute beneficial interests in a liquidating trust (as defined in the section entitled “Material United States Federal Income Tax Consequences” in the proxy statement) to you, you would be required to recognize any gain in the taxable year of the distribution of the liquidating trust beneficial interests (to the extent that you have not recognized such gain in prior taxable years), although you may not receive the cash necessary to pay the tax on such gain. If you receive cash from the liquidating trust, you may receive such cash after the due date for filing your tax return and paying the tax on such gain. Distributions of beneficial interests in the liquidating trust will also constitute a final liquidating distribution that should allow the recognition of any loss. A summary of the possible tax consequences to you is included in “Material United States Federal Income Tax Consequences” in the proxy statement.

YOU ARE URGED TO CONSULT YOUR OWN TAX ADVISOR AS TO THE SPECIFIC TAX CONSEQUENCES TO YOU OF THE TRANSACTIONS DESCRIBED IN THE PROXY STATEMENT, INCLUDING THE APPLICABLE FEDERAL, STATE, LOCAL, AND FOREIGN TAX CONSEQUENCES OF SUCH TRANSACTIONS.